Table Of Content

(RTTNews) - Cruise company Carnival Corp. & Plc (CCL, CUK, CCL.L) announced Monday that it has priced its private offering of 500 million euros aggregate principal amount of 5.75% senior unsecured notes due 2030. Street expects RCL’s revenue for the quarter ended March 31, 2024, to increase 27.7% to $3.68 billion. Its EPS for the quarter ended June 30, 2024, is expected to increase 30.4% year-over-year to $2.37. It surpassed the Street EPS estimates in each of the trailing four quarters.

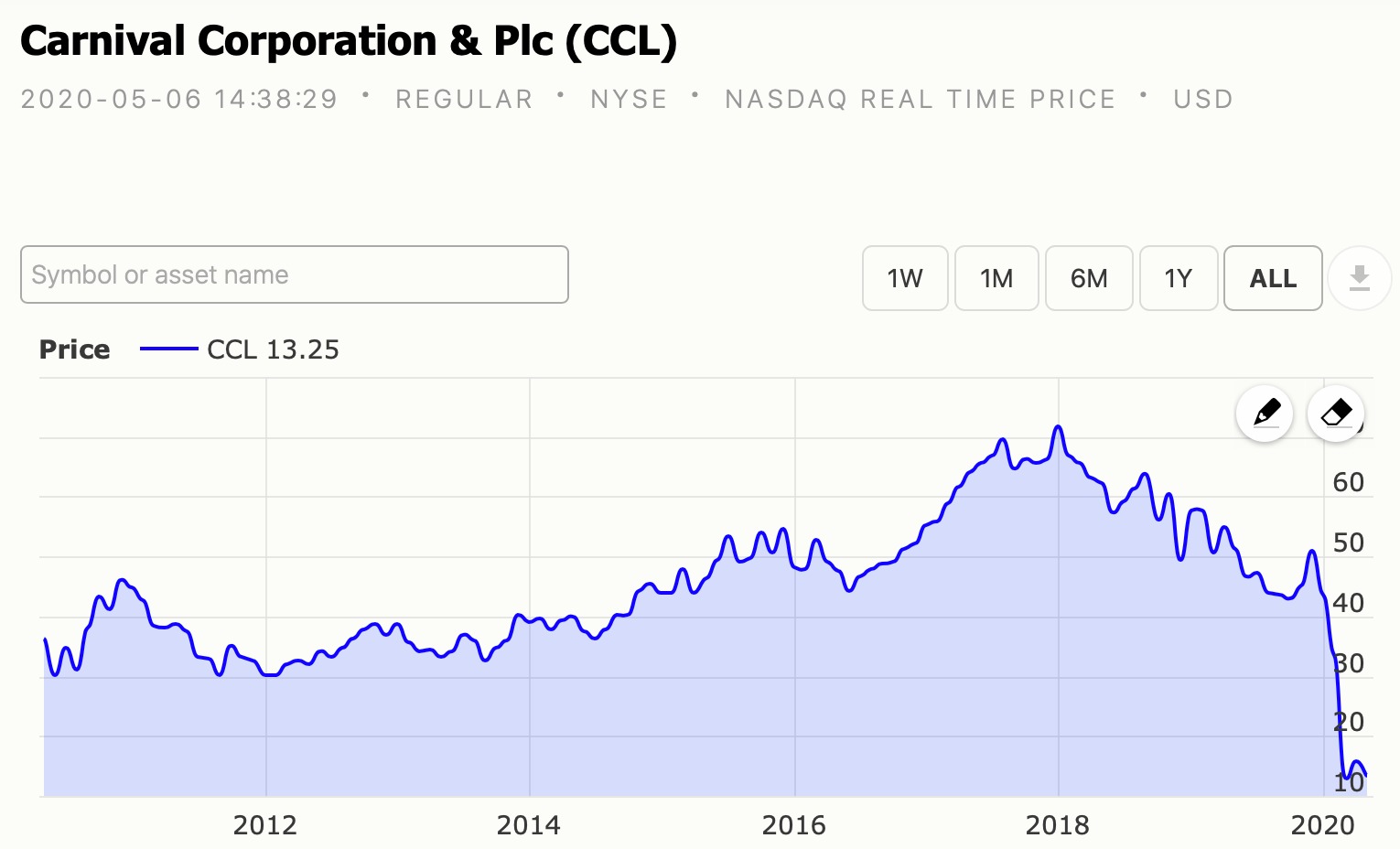

About Carnival Co. & Stock (NYSE:CCL)

However, it has made a roaring comeback fueled by pent-up demand. Bookings have been robust, along with improvements in occupancy. Demand has been so strong that companies are looking to add capacity. Despite the promising outlook, not all travel stocks are well-positioned to benefit. Therefore, investors could look to avoid Norwegian Cruise Line Holdings Ltd. (NCLH), given its poor fundamentals and weak growth prospects.

Carnival Management

But it's best to think about the bigger picture, turning our attention to the long term. That's even after shares soared 76% since the start of 2023 (as of April 18). Carnival Co. &'s stock is owned by a number of institutional and retail investors. Insiders that own company stock include Arnold W Donald, David Bernstein and Randall J Weisenburger. Carnival’s 9 brands provide access to a wide range of cruising styles and destinations including the Caribbean, Alaska, Australia, New Zealand, Hawaii, England, and ports in Asia. The company is headquartered in Miami, Florida and has offices around the world.

carnival corp.

The travel and tourism industry is booming thanks to a rise in young travelers, greater interest in experiences, and the return of business travel. Recent travel trends show that guests now prefer trips that mix work with exploration, relaxation, and discovery. Additionally, travel companies are adopting digital solutions to meet evolving consumer needs and sustainability goals helping boost the industry’s growth prospects. To be clear, I still believe Carnival is an extremely risky business to own. As of Feb. 29, the company had a massive debt load of $31 billion.

It's easy to say this with the benefit of hindsight, but I don't necessarily think it's shocking to see Carnival putting up such strong numbers right now. Unless you were convinced that demand for cruise travel would permanently fall off a cliff, I bet you expected that this business would experience a reversion to the mean. The company’s growth hit a new stride in 1987 following the IPO which floated 20% of the company on the open market. The proceeds from the IPO allowed the company to embark on a voyage of acquisition and now Carnival is the world’s largest travel and leisure business.

For second-quarter fiscal 2024, it expects adjusted cruise costs excluding fuel per ALBD (in constant currency) to increase approximately 3% year over year. The increase includes an unfavorable impact of 1.3 percentage points attributed to lower ALBDs resulting from the Red Sea rerouting, as certain ships repositioned without guests. The world's largest cruise company's commitment to sustainability and the enchanting beauty of Mahogany Bay in Roatan, Honduras, recognized with top environmental honor MIAMI , April 4, 2024 /PRNewswi... Beyond what we have stated above, we also have given CCL grades for Growth, Value, and Stability. The cruise industry was one of the worst affected by the pandemic.

EPS Revisions

A lot of this capital was raised to buy the company time throughout the pandemic. But that's a huge burden that adds tremendous financial risk should there be economic weakness. During that 12-week stretch, the company hit a first-quarter record for sales. Key to this strong momentum is, without a surprise, robust demand from consumers.

Carnival Cruise Lines Sold Off After Earnings: Buying Opportunity, or Stay Away? - The Motley Fool

Carnival Cruise Lines Sold Off After Earnings: Buying Opportunity, or Stay Away?.

Posted: Tue, 03 Oct 2023 07:00:00 GMT [source]

The company’s goal is to provide extraordinary vacations at an exceptional value. As of 2022, the company laid claim to nearly half of the global cruising market share with several new ships in the works. World's largest cruise company releases annual report detailing its global sustainability performance and progress, including surpassing several sustainability goals well in advance MIAMI , April 10, ... For the fiscal fourth quarter that ended on December 31, 2023, RCL’s total revenues increased by 27.9% year-over-year to $3.33 billion, while its operating income rose considerably to $570 million. The company reported adjusted EBITDA of $1 billion, up 145% over the prior-year quarter.

Carnival Cruise Line was launched in 1972 with one second-hand ship and a tank of fuel. The first port of call was San Juan, Puerto Rico, but soon more were added. The original growth strategy included a festive atmosphere, features and amenities unlike any other cruise line at the time. Slow to start, the growth strategy shifted into overdrive in 1980 when Carnival shocked the world by building its own ship.

Wall Street Is Starting to Come Aboard Carnival Stock - The Motley Fool

Wall Street Is Starting to Come Aboard Carnival Stock.

Posted: Thu, 21 Sep 2023 07:00:00 GMT [source]

RCL shares were trading at $128.42 per share on Thursday afternoon, up $0.45 (+0.35%). Year-to-date, RCL has declined -0.83%, versus a 5.38% rise in the benchmark S&P 500 index during the same period. Over the past nine months, NCLH’s stock has declined 13.2% to close the last trading session at $18.02. It's easy for investors to become short-sighted and focus too much on financial results from one year or one quarter.

The company is actively pursuing additional initiatives to sustain its momentum and tap into untapped revenue opportunities. Three new ships are in development, poised to generate heightened interest and demand for their respective brands. The planned improvements aim to elevate the guest experience significantly, resulting in a substantial revenue boost across the brand while simultaneously reducing its environmental impact and enhancing the performance. Shares of Carnival Corporation & plc CCL have rallied 42.5% in the past year compared with the industry’s 11% growth.

Proceeds from the offering of senior unsecured notes and cash on hand to be used to redeem €500 million 7.625% senior unsecured notes due 2026; cash on hand to repay $800 million of the term loan faci... Carnival Corporation owns and operates cruise ships offering cruises to all major vacation destinations including North America, United Kingdom, Germany, Southern Europe, South America, and Asia Pacific. The Company, through a subsidiary also owns and operates hotels and lodges. The company expects to use the net proceeds from the Notes Offering, together with cash on hand, to redeem its 500 million euros 7.625% senior unsecured notes due 2026. This would result in a reduction in interest expense on this outstanding debt of nearly 2%.

It has an F grade for Sentiment and a D for Stability and Quality. However, these companies are still laden with massive debt, which they had undertaken during the pandemic to stay afloat. The high debt levels have meant that cruise lines slowed capital expenditures, delayed overhaul projects, and deferred new construction. Cruise companies are tackling challenges like over-tourism, with destinations around the world limiting or outright banning them from ports.

Its 19.26% trailing-12-month Capex / Sales is 533.2% higher than the 3.04% industry average. However, the stock’s 3.67% trailing-12-month Return on Total Capital is 39.9% lower than the 6.11% industry average. In terms of the trailing-12-month asset turnover ratio, NCLH’s 0.45x is 55.1% lower than the 1x industry average. Its 36.04% trailing-12-month gross profit margin is marginally lower than the 36.18% industry average.

No comments:

Post a Comment